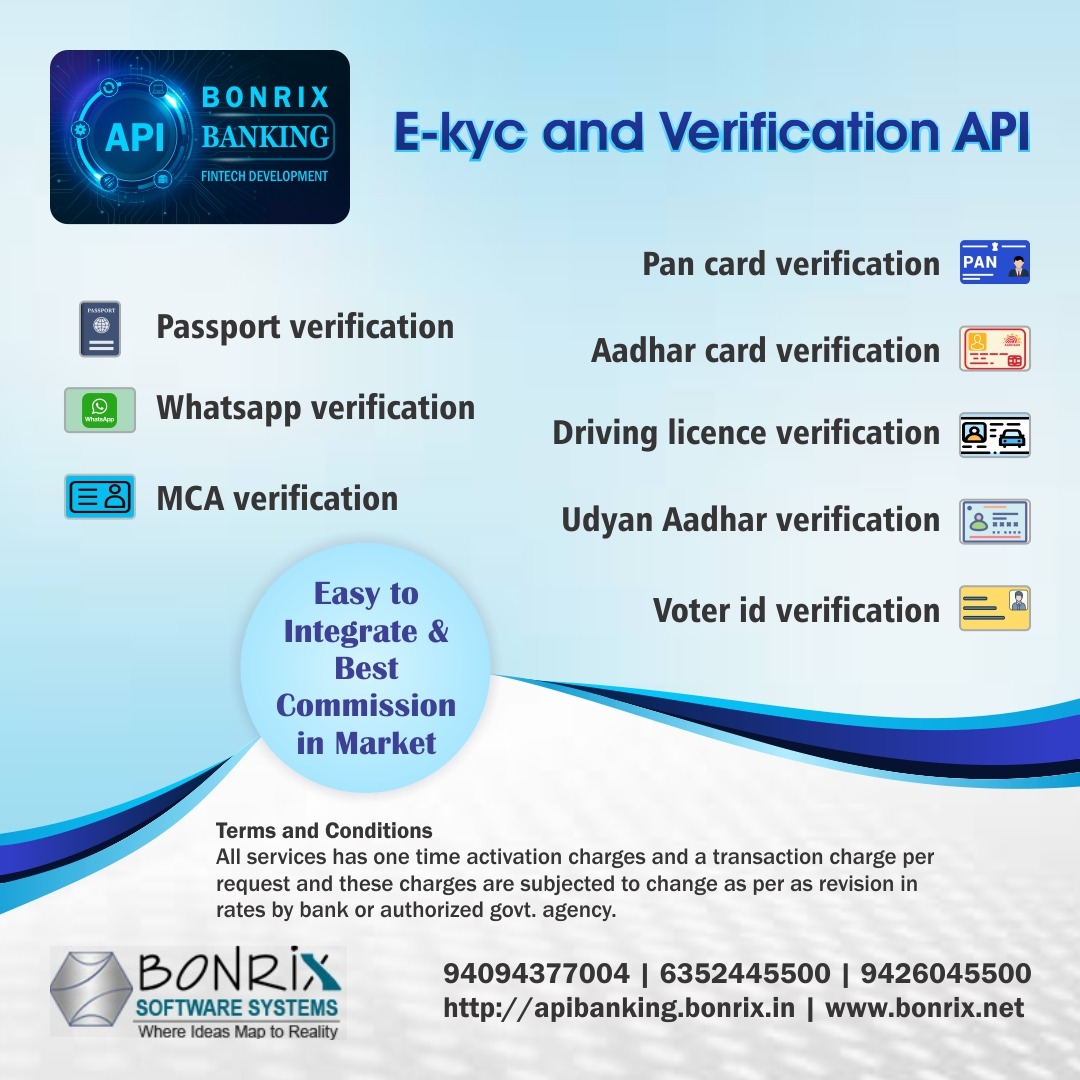

E-kyc and Verification API

E-kyc and Verification API

Pan card verification

Aadhar card verification

Voter id Verification

Driving licence Verification

Udyan Aadhar Verification

Passport Verification

Whatsapp Verification

MCA Verification

Easy to Integrate & Best Commission in Market

Terms and conditions: All services has one time

activation charges and a transaction charge per

request and these charges are subjected to change

as per as revision in rates by bank or authorized govt. agency.

Bonrix Software Systems

6352445500 | 9426045500 | 6352545500